Resource List for Secondary Market Research

While it won’t give you specific answers or intelligence about your business, secondary market research is critical to running a successful organisation. Unlike primary research, this type of research is conducted through sources who’ve already compiled the data for you: government agencies, industry and trade associations, your local chamber of commerce, labour unions, media sources, and so on.

If it doesn’t give you direct insight into your business, what kinds of questions will secondary market research answer? Here are a few we can think of off the top of our heads:

- Is there even a desire for my product or service? What does customer demand look like? How many people would be interested in the product or service I’m considering selling?

- Who, exactly, makes up my target market? What are their demographic characteristics? How old are they? Where do they live? What are their income levels?

- How saturated is the market? How many offerings like mine are currently available to consumers? What are consumers paying for these alternatives?

- What are the current conditions in my industry? The trends in customer preferences? The statistics on consumer behaviour? Are there any threats my industry is facing?

- What are the economic conditions my business is operating in (both local and international)? What do employment rates and income ranges look like?

- Are any technological shifts influencing my industry? Are new markets opening up that could mean growth for my business?

- What’s the current state of the labor market? How many people possess the skills I’m looking for in my team? How much should I anticipate paying my employees?

Granted, you won’t be looking for the answers to all of these questions at once: Before digging in, you’ll have established specific market research questions through a situation analysis of some kind. Approaching secondary research with a pre-established goal will keep you from falling down the rabbit hole of data… which, as you might infer from the following list, would be quite easy to do. So keep your research questions front-of-mind, and choose your secondary sources with care. Most of them are freely available online or can be sent to you upon request.

Note that most of the secondary market research sources below are U.S.-centric. Similar resources are available at the Office for National Statistics (UK), the British Chambers of Commerce (UK), the Federation of Small Businesses (UK), and canadabusiness.ca (for labor and employment data, demographics, industry sector data, data on the Canadian economy, and more). That said, here’s a list of common sources for secondary research… and where to find them:

Government Resources

The US federal government is the largest data-generator in the United States, with a number of offices dedicated almost solely to collection and analysis—in other words, troves of existing market research data. Access to their findings is free; and you can be confident that the data is well-reviewed and accurate. Check out:

The U.S. Census Bureau

The Census Bureau is a goldmine of information on populations, demographics, market sizes, and more. It provides a holistic picture of the U.S. economy, but will also allow you to drill deep through a variety of data tools and apps. With their American FactFinder, for example, you can enter a state, city, or zip code and the tool will generate economic, social, household, and demographic data for that area.

The site offers everything from interactive maps to a Census Business Builder designed to help you “determine the best location for your business.” (It’ll tell you, for example, how much people in a given area spend on your type of business.) You might also check out their Consumer Price Index for guidance in determining your own pricing, their Industry Statistics Portal for more industry-specific information, or their International Programs for “demographic, economic, and geographic studies of other countries”… and this only scratches the surface. If it all feels overwhelming, the Census Bureau also offers webinars, how-to videos, and hosts trainings about how to navigate and make the most effective use of their data.

The U.S. Small Business Administration

The U.S. Small Business Administration provides statistics on economic indicators, employment, income and earnings, production and sales, trade, demographics, and more. We’d suggest you start with their resources page, or check out their free SizeUp tool that lets you see how you stack up against the competition. Just enter your industry and city; and the tool will display a map of your competitors, suggest the best locations to advertise, and let you compare yourself to your competitors based on revenue, worker salary, and more.

The SBA’s partners include SCORE and a variety of Small Business Development Centres across the country. These organisations provide assistance to small businesses in the form of consulting and mentoring services, as well as low-cost trainings.

The Bureau of Labor Statistics

The Bureau of Labor Statistics is an excellent site for industry-specific information; and if your business is B2B, it’s an especially good resource. They offer databases and tables on everything from prices and inflation, to employment, productivity, pay, benefits, occupational requirements, and more. The bureau’s routine economic reports cover labor turnover, layoffs, and productivity and costs by industry and by region.

The U.S Department of Commerce

The U.S. Department of Commerce has offices across the country and publishes information about products, services, and industries. It’s a particularly great resource if you plan to get into exporting: The department’s International Trade Administration publishes reports and statistical surveys on both domestic and foreign markets, many of which are available for download.

Another branch of the Department of Commerce, the Bureau of Economic Analysis, publishes economic indicators including personal income, spending, and savings data by quarter. If you want to know whether spending on a product or service is rising (shoes? apps? eating out?), this is one place to find out.

State and county publications

Local governments regularly publish data on population density and distribution within their own census tracts. You can drill down into precincts, neighbourhoods, water districts, and more. And by reading backwards, you can discover things like population and employment trends. Data from both City and County Clerk’s offices may also be valuable. Check out the directory at State & Local Government on the Net to find your city and county offices.

While Chambers of Commerce are not government organisations, they do work closely with the government. So get to know the employees in your local office. They likely have a business development department to encourage new and local businesses. They’ll have information for you on population trends, local industrial development, networking, community resources, payrolls, and more.

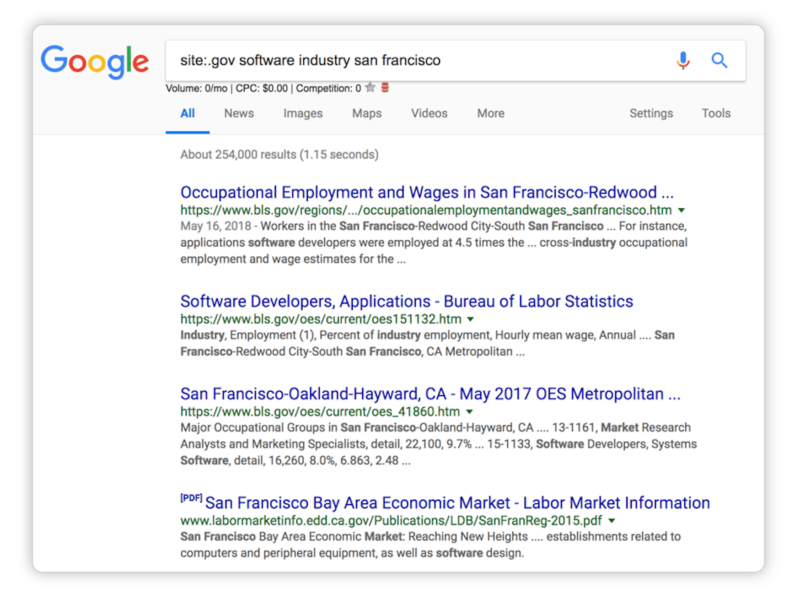

Finally, a Google search preceded by site:.gov will limit search results to government websites. You’ll discover organisations that aren’t on our list. Here’s what it looks like:

Notice that the first three search results are from the Bureau of Labor Statistics… but that fourth result is from the State of California’s Employment Development Department (EDD). (Other organisations that made the first page were the California Workforce Development Board and the Equal Opportunity Employment Commission.) Of course, you’ll drill down your search for more specific data than our example shows.

Notice that the first three search results are from the Bureau of Labor Statistics… but that fourth result is from the State of California’s Employment Development Department (EDD). (Other organisations that made the first page were the California Workforce Development Board and the Equal Opportunity Employment Commission.) Of course, you’ll drill down your search for more specific data than our example shows.

Commercial Resources

Unlike government publications, commercial sources often involve costs in the form of subscription and association fees… but the good ones are well worth the price. These sources include trade associations, research associations, publicly traded corporations, banks, and other financial institutions. We’ll focus on the first two here:

Trade associations

Trade associations allow you to focus exclusively on your industry. They’re formed from groups of businesses with the purpose of serving specific fields; and there’s almost certainly one for yours—whether you’re a massage therapist, a brewer, a paper maker, a marketer… you get the picture. Find an association for your industry through a basic online search; or use the Directory of Associations, the Encyclopedia of Associations, or the National Trade and Professional Associations Directory. (The print editions of the latter two are likely available at your public library… and while we’re at it, the reference librarian at your local library is another terrific resource. They’ll help you get familiar with the business reference section.)

Because they’re a collaborative effort between businesses who have a lot to gain from a dynamic organisation (they want to boost both competitiveness and industry profits), trade associations are typically very active, regularly publishing directories, targeted studies, lists of reference materials, and statistical information for their members. Some of them also offer services for networking, and—in some cases—mentoring. Because these organisations are specialised, the information they gather is accurate, thorough, timely, and typically worth the price you’ll pay for membership. And conversations with other members can be a way to discover additional information about customer bases, regions, or general business practices.

Pro Tip: If your business is B2B, don’t just read the publications from your own trade association; read the publications from your customers’ associations as well. After all, the success of their business will play a role in the success of yours.

Research associations

Research associations are typically independent organisations, but are occasionally affiliated with trade associations. They’re made up of third-party analysts, skilled in research, whose goal is to help entrepreneurs and businesses with the occasionally-complex task of market research. If you’re looking for specialised, tailored reports, research associations will be among the places to get them.

Dun & Bradstreet, for example, provides data, analytics, and commercial insights for businesses. Their database contains more than 120 million business records spanning more than 1,000 industries. Through their subscription service, users can purchase in-depth industry reports, as well as detailed information about competitors that includes history, customers, employees, directors, financial filings, and recent business developments.

Other research associations include IBISWorld, Forrester, Gartner, Statista, and Mintel; the American Marketing Association’s “Top 50 Market Research Firms” might be worth checking out. Each has a different membership structure, emphasises different data, and offers different overall user experience. So if you go this route, do your due diligence, and make sure you choose the company that will give you the most valuable insights.

Educational Institutions

The business departments of colleges and universities conduct more research on… well, business than just about anyone. While much of this academic research is behind a paywall (meaning you’ll have to subscribe to a specific journal or pay a fee to access a website), it ranges from graduate student projects and theses to faculty-based projects—and much of it involves market research in some way.

What’s more, many professors in these departments do marketing and business consulting on the side. So contact the administration of the appropriate department (business, marketing) at your local college. There may be a resource there who’d be willing to help you with your market research—or who could put you in touch with a professional who could.

Additional Market Research Resources

What’s below is, necessarily, a short list—there are thousands of tools and options out there. (And that number’s growing!) Here are some solid contenders in the market resource pool:

BuiltWith will let you see what technologies your competitors’ websites are using—information that may help you decide what to implement on your site.

Census Viewer is another source of census data in a very user-friendly format.

Consumer Barometer is an interactive tool that “helps you understand how people use the internet across the world” (for instance, how prospects research products before buying).

MarketingCharts is a self-described “hub of marketing data, graphics, and analyses. Want to know the trended cost of a Super Bowl ad? How B2B marketers are tackling lead generation? How many Millennials there actually are—and if they’re still watching TV? You’ve come to the right place.”

MarketResearch.com has consolidated more than 250,000 research reports from hundreds of sources, and it’s updated daily. You pay only for the sections of the reports you need.

Nielsen is a global information company that specialises in consumer behaviour. Find out what consumers watch… and of course, what they buy.

The Pew Research Centre provides information on public opinion, demographic trends, media content analysis, social issues, and more.

PR Newswire offers access to all press releases and press-related stories.

SBDCNet provides small business reports and industry profiles, including information on shifts, typical startup costs, and more. Check out their shortlist of market research directories, and see if your industry is in there.

SimilarWeb offers access (free and paid versions) to website traffic data. You can see how much traffic your competitors’ online stores receive to get a sense of the size of your potential market.

Strategic and Competitive Intelligence Professionals is a “community of business experts across industry[ies], academia, and government who come together to build and share strategic intelligence, research decision-support tools, processes and analytics capabilities.” They host webinars, conferences, and summits.

Zoom Prospector lets you input variables to find the right location, and community, for your business.

We’d understand if you’re feeling overwhelmed right now. (We’ve been there!) So give yourself a break and start small. Begin with the resources that feel most compelling to you… or maybe ask friends in your industry what resources they use. Remember, market research isn’t a one-time event; you’ll be conducting it for as long as you’re in business, so there’s no need to rush to pack it all in this week. Moving slowly will ensure you’re paying attention to the important details.

By now you’ve got a pretty comprehensive sense of what secondary research entails. Now it’s time to move on to primary market research. In the next section, we’ll give you a broad overview of primary market research, including the leading methods of primary data collection. We’ll also help you determine which of these methods is best for your market research project.

Related Articles

Conducting Primary Market Research

If you’ve been following along with us on this market research journey, you’ve already conducted a situation analysis to determine your business’s market research question. You’ve also begun conducting competitor research and looking into other forms ...Conducting Competitor Research

While it can be split many ways, market research takes two basic forms: primary and secondary. The latter—secondary research—deals with data that already exists, and has been compiled and organised for you (we’ll get to primary research in later ...Introduction to Market Research: When and How to Start

Welcome back to our introduction to market research! As you probably remember, we first introduced the idea of market research by comparing it to solving a mystery. Though the end results are different (we imagine your market research won’t conclude ...Introduction to Market Research: What It Is and Why You Need It

Have you ever read a mystery novel you really enjoyed? If so, you understand the thrill that comes with getting to know a cast of characters, finding clues, and using logic to unlock the story’s secrets. In this introduction to market research, we’re ...Creating a Killer Market Research Survey

Sometimes the best way to discover what your target market really thinks of your business is simply to ask it. If you’ve been in business for more than a couple of hours, you know that consumers have strong opinions. Offering a market research survey ...